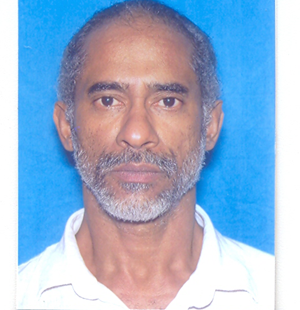

There is an e-finance revolution taking place in Africa. It is called e-money or mobile money and it makes use of cell phone technology thereby bypassing brick and mortar banks. In the middle of this revolution you will find a Jamaican, Lascelles “Butch” Chen, who has lived in East Africa for over 25 years.

In 2013, Chen founded MEDMobile Limited a private limited liability company in Nairobi, Kenya by assembling a team that includes, a micro finance banking practitioner, an expert in rural finance, best practices and knowledge management, an ICT development and marketing professional and entrepreneur, expert software developers and programmers, a senior finance and management specialist, and a corporate lawyer to develop e-money software applications.

Chen is now marketing the Chama Mobile Software Application (CMSA) to Financial Service Providers (FSPs) to deliver a truly national outreach, and an all-inclusive e-money based Grameen type savings and credit service. All customers can access this financial service only through the SMS and e-money services of their mobile network operator (MNO). The service is basic, simple to learn, to teach, and to use.

MedMobile’s initial focus is on the rural and remote rural communities of Kenya, Tanzania and Uganda, where approximately 84 million people live.

How did you end up in East Africa?

From my teenage years I had always been a Pan-Africanist, and the possibility of living and working in Africa was one of my main ambitions to achieve before my 30th birthday. I had the opportunity to travel to East Africa in 1986 to visit some other Jamaicans who were living in Tanzania and Ethiopia, and I also visited Kenya. I then chose to move to Kenya which at the time looked to be a relatively easy country to settle in, especially that the people spoke English and their education system looked progressive.

Who or what motivated you to go into business?

As you can see from my name, I come from a Chinese family background, where doing some kind of business was the norm and not the exception. My grandfather (RIP) had a shop in Four Paths, Clarendon and my aunts, uncles and parents always had some business initiatives going on, even if they also had regular jobs. My mother also inculcated a strong work ethic in me, as I cannot remember a single holiday from school where she did not have a community-based income generating plan for me to become involved in. Jobs ranging from babysitting to painting wooden window louvers to working in construction….she had many friends in the public and private sector, who would always help her to find small jobs for me to do.

Two of her teachings that I have carried with me till this day are: “mama have and fada have, but blessed is di pickney dat have fi demself” and “hard work neva kill anybody yet, an so it won’t kill you either.”

Why this business?

The opportunity presented itself at this time and I was able to use my personal banking and finance expertise and network of professionals who have a similar mindset to mine and the conviction to develop this service for the masses.

Here in Tanzania (and indeed throughout most of sub-Saharan Africa), approximately 80% of the population live and work in agriculture in the rural and remote rural locations and hence have no access to formal financial services. I saw this as a massive challenge that was being addressed using the old brick and mortar approach in trying to expand financial services to the rural areas.

I was convinced that with the current level of ICT innovations which have created e-money platforms and ICT integration possibilities, that I could develop an application to facilitate the delivery of mass market financial services. The Grameen micro-finance banking methodology easily lent itself to full automation and I decided to use that methodology as the engine of a phone-based savings and credit ICT software application.

What is your competitive advantage in this industry?

Our product offers a service that has been approved by the Central Bank and a tried and tested methodology that has now been fully automated. We have been allowed to use the KYC (Know Your Customer) database of the MNO to facilitate rural based customers to open formal bank accounts, without having to travel at all.

How will the CMSA change the life of the customers?

It is a fact that wealth creation and economic advancement at all levels, i.e. from personal through corporate to national is based on savings accumulation. All the research that has been done on grass-roots (bottom of the pyramid) populations has shown that the most sought after financial service is savings, and more so, formal savings services.

The CMSA allows customers who are mobilized into groups to open bank accounts using their mobile phones. They are able to save and subsequently are able to access programmed (i.e. no application process) credit. This simple bundle of savings and credit services will help the customers to establish a strong financial foundation by acquiring assets and savings.

What is the Grameen micro-finance model?

The Grameen micro-finance model is a group-based financial service which uses cross-guaranteeing instead of collateral to secure the loans. Peer pressure has been the cornerstone of the long term success of this methodology that was invented by Prof Younis, who received a Noble Peace Prize for his work in this area of micro-finance technology in his home country, Bangladesh.

Members are in a group of 5 to 50 persons and agree to save a set amount every week. The group has three sub-groups for the lending cycles. After an initial period of four weeks of savings, loans are given to the first sub-group, and after another two weeks to the second sub-group and after another two weeks to the final sub-group. The loans are a multiple of the savings of the individual at the time of the loan offer.

The methodology is highly mathematical and even defaults can be comfortably planned for. Loan loss rates for this methodology are normally 5% or less, and it generates a substantive amount of loan interest to make it commercially viable, even within the brick and mortar approach.

How does the company earn its revenue in this business model?

Medmobile Ltd earns its revenue from the financial service provider who is using the CMSA. We earn a monthly commission income of US$1.00 for each customer who is on the system at the end of each month. So for example, if there are 100,000 customers on the system, we will earn US$100,000 for that given month.

However, in these MNO collaborations with commercial banks, we have seen very high customer uptake rates because of the massive nationwide advertisements. It is not uncommon to reach 1 million customers within the first 12 month period. Our current collaborating MNO already has over 10 million customers, so we are confident that our business model will be able to generate substantive revenue levels in the shortest possible time frame.

What were some early challenges that you faced?

Sorting out the technology design and finding the venture capital investors

Is there a favorite moment in business you can share?

When the first customers in the pilot test actually opened their bank account and set up their saving and credit group using their mobile phone….

What are some business challenges you currently face?

The slow pace of integration of the big companies that we need to collaborate with.

Other than the money what types of satisfaction do you get out of your work?

I get my satisfaction from knowing that this mobile banking business model mobilizes the savings of the poor people and uses that same money to provide loans to them….turning the existing banking models upside down where they currently use the poor people’s savings to lend to the rich people.

How do you remind yourself of what’s important?

I currently live in a village where there is no piped water or electricity…our water is trucked in and our electricity comes from a solar system. Every day I see the poor people around me so I am constantly reminded of the work that needs to be done to help them…

Do you have a specific daily routine?

Yes…first it’s to wake my daughter and get her off to school…..then it’s just work, work, and work until she gets home. Sometimes I am working here at home on the internet and sometimes I am traveling out to the villages to work with the local people there. If I am at home I take a small break to greet my daughter when she gets home and find out about her day. Then I get back to work till later when I break again to help her with her homework. Then it’s back to work for a few more hours till it’s time to shut down and wrap up the day’s home issues.

What do you do to unwind?

I like to play some reggae music (old time selections from Studio 1, Treasure Isle and Channel 1) on my music system, play my guitar, play with my daughter. I also like to take my daughter out to the park or swimming, and in the evenings I like to have some adult drink and a nice cigar to pass the time.

Where were you born and where did you grow up?

I was born in Mandeville, Jamaica and grew up in Claremont, St Ann…then we moved to Harbour View and then Cassia Park off the Red Hills Rd in Kingston.

Your favorite Jamaican food is…?

Breakfast: ackee and saltfish, fry dumplings and plantain. Lunch or dinner: oxtail and broad beans with fish and rice and peas. We have a great Jamaican restaurant (Velisa’s Jamaican Restaurant) here in our capital city Dar es Salaam, which is run by a fantastic lady entrepreneur (Ms. Betty Delfosse-Ingleton).